CONTACT

Name: StableLab

Delegate Address: base.stablelab.eth

Governance tracking: Boardroom, Internal tracker

Forum: Kaf_StableLab

Telegram: @kaftelegram

Discord: kaf#6633

Twitter: https://twitter.com/Stablelab

Newsletter: https://stablelab.substack.com/

Languages: English, Spanish, German, Dutch, Romanian, Korean, Chinese

ABOUT

StableLab is a governance firm focused on professional delegation, DAO framework design and product development. We work with various projects, from the ones just starting their journey to decentralization to the most prominent DeFi protocols.

Our systematic framework for DAOs covers governance methodologies, decentralized workforce, implementation, documentation, communication and community engagement. There is no one-size-fits-all approach, but we provide a framework of principles and tools we have developed throughout our experience.

We scale DAOs sustainably.

EXPERIENCE

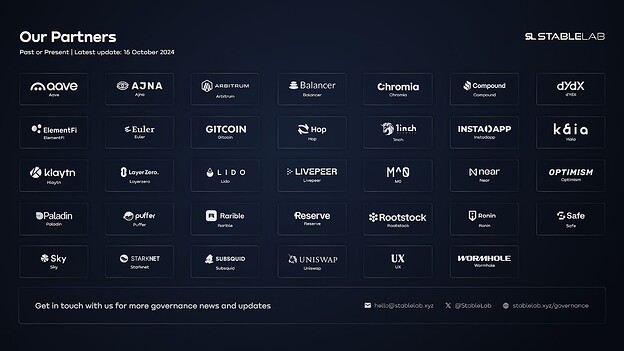

We are the leading professional delegate team with a track record across major DeFi protocols, including MakerDAO, Optimism, Aave, 1inch, Balancer, Element, InstaDapp, Hop and more.

We pioneer delegation work through high governance standards, extensive research, hands-on expertise and the consistent use of a code of conduct. Pushing forward web3 and DeFi since 2018, StableLab’s co-founders previously spent 3.5 years at the Maker Foundation.

Governance delegates and roles currently (or previously held) by StableLab.

View all our proposals, votes and milestones at stablelab.xyz /governance.

VALUES & CONDUCT

A. VALUES - A.R.T.

- Activity: We participate in every aspect of the governance process, from creating and presenting proposals to providing feedback in the forums and actively voting.

- Research: Our decisions are backed by a team of experienced researchers and PhDs.

- Trust: We act unbiased and transparent, according to our code of conduct - driven by a strong set of ethics and values.

B. DELEGATE CONDUCT

- Use values to guide actions.

- Maintain impartiality and transparency in participation.

- Rely on data, research and prior expertise for proposals and votes.

- Apply battle-tested internal policies for consistency.

- Consult with the team for quality outcomes.

WHY SUPERFLUID

Superfluid is a revolutionary protocol focused on real-time asset streaming, enabling continuous and efficient payments for salaries, subscriptions, vesting, and more. We chose to be delegates for Superfluid because we believe in the transformative impact of its technology on how DAOs and crypto protocols manage financial flows.

With reliable governance aligned with Superfluid’s values, the protocol can scale sustainably, unlocking new opportunities for users and developers. Our role as delegates is to support Superfluid’s mission to redefine financial infrastructure in Web3.

StableLab is committed to playing a key role in turning Superfluid’s vision into reality by bringing high governance standards and expertise to the table.

DISCLOSURE

Through our holding company, we have invested in multiple projects to advance growth and governance for them. See the full list here.

We contribute to various protocols’ governance, such as MakerDAO, Optimism, Aave, 1inch, Balancer, and Element. See the full list here.

When applicable, we will disclose potential conflicts of interest in our rationale.

WAIVER OF LIABILITY

By delegating to StableLab, you acknowledge and agree that StableLab participates on a best efforts basis and StableLab will not be liable for any form of damages related to StableLab’s participation in governance.