Ok let’s work together

It makes sense to us as well. Ready to collaborate and contribute more to that.

We really need to implement a transferability mechanism to allow for fair token distribution to the greater masses. As it stands, there is eminent risk of undesirable market conditions like token concentration, possessing the potential to cause unwanted market conditions such as instability, potential for manipulation, and ultimately lead to sentimental fear causing negative effects like customer deterrence, for starters…

To that end, implementing token transferability should be a top priority handled with caution, in a safe, well-planned, and most urgent manner. User @Euphoria and others have mentioned viable solutions for a staged progressive rollout and/or “soft” solutions with the ability to be rolled out efficiently as a temporary and effective basis for a quicker resolution as needed…

Overall, the community seems to be in a well aligned and cohesive majority in favor of SUP token transferability as a top priority. Hopefully the SUP protocol, project team members, and their stakeholders release a working remedy in a timely manner. I believe in this project, along with many of its core developers, and have high hopes of it succeeding!

Great idea and thanks for taking action!

Great idea i will support this

Regarding the SUP liquidity strategy, I would like to throw an idea into the mix: Yield Forwarding

If the DAO was open to pairing SUP with OETH on mainnet or (superOETHb on Base) instead or in addition to ETH, we could turn on Yield Forwarding for the pool (more info here and here). With Yield Forwarding we can take the underlying yield generated from the OETH (or superOETHb) in the pool and have it sent directly to a DEX’s gauge as a bribe on the pair - this basically creates a constant bribing system on the pair, funded by OETH (or superOETHb) itself rather than being paid by Superfluid.

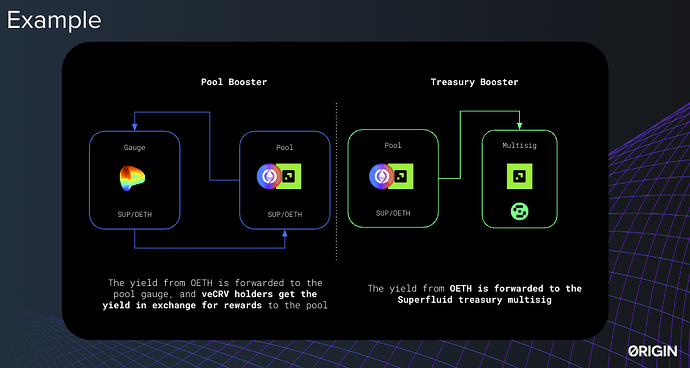

Alternatively instead of going straight to bribes, the yield can be forwarded directly to the Superfluid DAO treasury - so the DAO would be earning the pool’s trading fees, plus the OETH (or superOETHb) yield on top. Here is a simple graphic of the two different applications:

Presumably the pool volume should be similar on a SUP/OETH (or superOETHb) pool as it would be on a SUP/ETH pool since OETH (and superOETHb) is 1:1 with ETH. Yield Forwarding is also possible with SUP/OUSD, Origin’s stablecoin. About 30 different projects have set up pools with Yield Forwarding enabled and have been enjoying the passive yields across Base, Sonic, and mainnet.

As a delegate, I see interesting potential in the proposed use of Yield Forwarding, both to support liquidity incentives (Pool Booster) and to strengthen DAO cash (Treasury Booster).

Some points I would like to highlight:

The Pool Booster approach allows for an automated and decentralized continuous kickback system, guaranteed directly from OETH/superOETHb returns without burdening the Superfluid treasury. This can increase visibility and volume in the SUP/OETH pool on the DEX.

The Treasury Booster approach is more conservative, but benefits treasuries directly with additional yield — it can be a source of ongoing income outside of trading fees.

A balance between these two approaches could be considered — for example, splitting the proceeds so that part goes to bribes and part goes to the treasury.

Before supporting further, I suggest doing:

Cash flow simulation for both scenarios.

Evaluate the risks of integration with OETH/superOETHb, especially in terms of liquidity and security.

Consultation with the community regarding preferences between liquidity or cash strengthening of the DAO.