Thank you everyone for this thoughtful and nuanced discussion. I deeply appreciate the engagement from @graven, @jameskbh, and others.

I’d like to offer a consolidated response to the key points raised across this thread and help clarify the current intention of SIP-5 while reinforcing a path forward that balances ambition with responsibility.

On Vision and Legitimacy

On Vision and Legitimacy

SUP transferability is not just a technical update—it’s a symbol of the DAO’s maturity, a gateway to economic participation, and a foundation for deeper alignment between contributors, builders, and capital. That said, we all share a responsibility to get it right, not just to enable movement, but to ensure that when movement begins, it is meaningful, secure, and value-aligned.

Security & Smart Contract Audit Readiness

Security & Smart Contract Audit Readiness

As noted by @graven and others, security is non-negotiable. It’s important to clarify:

SIP-5 does not immediately implement a technical change, but instead acts as a community mandate that authorizes the DAO and Foundation to prepare for and execute transferability, subject to the necessary security review and operational readiness.

If the vote passes:

- Security Council oversight will still apply to any contract changes.

- The DAO can delay implementation until audits, bounties, or hardening of any smart contract upgrades (e.g., reserve system, if relevant) are complete.

- We can embed a final readiness checkpoint prior to execution.

Liquidity Provisioning & Market Setup

Liquidity Provisioning & Market Setup

Token transferability without liquidity planning could create an unstable or misleading user experience. This is a valid concern, and I support the idea of the Foundation:

- Coordinating LP incentives or DEX/CEX onboarding strategies

- Ensuring there’s market depth and price discovery

- Communicating clearly what to expect post-transferability

That said, the DAO should not be locked from deciding transferability at a governance level while waiting for the Foundation to act. Instead, a yes vote gives the DAO authority to initiate and lets the implementation date remain flexible until liquidity setup is complete.

User Experience & Frontend Coordination

User Experience & Frontend Coordination

Several of you rightly emphasized the importance of frontend readiness—wallet integrations, explorer tags, documentation, and user-facing portals. Again, SIP-5 does not require these to be completed at vote time, but rather mandates the DAO to start coordinating this work.

A successful “Yes” vote should trigger:

- A collaborative plan to finish user-facing updates

- A clear go-live communication plan

- Optional phased rollout or “soft unlock” depending on interface readiness

Distribution Metrics & Ecosystem Maturity

Distribution Metrics & Ecosystem Maturity

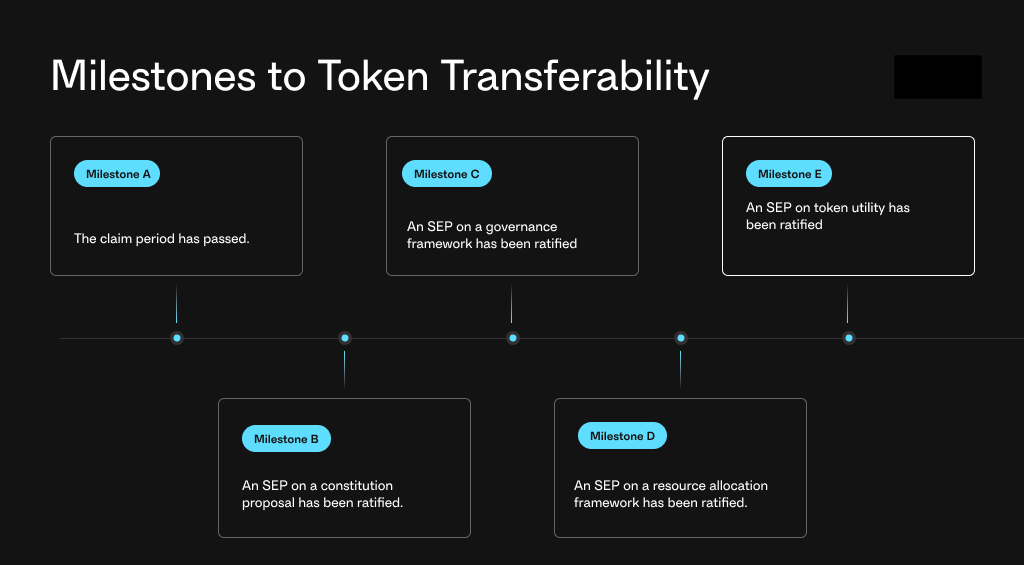

As @jameskbh and @graven noted, SafeDAO tied transferability to milestones. I believe that’s a great reference point. However, Superfluid is already in a stronger position in terms of engagement, thanks to Season 1 and the deep involvement of protocol-aligned users.

Rather than creating a rigid milestone framework now, SIP-5 can serve as the governance-level trigger to authorize implementation, while:

- Allowing for a Foundation-aligned execution window

- Encouraging a public checklist of readiness metrics (audits, liquidity, UI)

- Requiring transparent reporting before the final “unlock” occurs

Macro Conditions & Market Timing

Macro Conditions & Market Timing

Macro timing is a fair point. But it’s also inherently unpredictable. SIP-5 provides flexibility—it doesn’t demand immediate unlock but allows us to be ready when the conditions make sense. That may be this summer, next quarter, or tied to Season 2.

The key is: we don’t need to delay the decision just because timing isn’t ideal today. A DAO should be able to make a forward-looking call and activate implementation only when it aligns with market readiness.

Suggested Refinement Going Forward

Suggested Refinement Going Forward

If the community prefers, I’m open to proposing a follow-up “Readiness Signaling SIP” (as suggested by others) that:

- Defines optional checkpoints (e.g., audits complete, liquidity plan live)

- Gives transparency without blocking SIP-5

- Reinforces DAO <> Foundation coordination

This allows SIP-5 to act as the mandate, and the next SIP to define the “go-live” triggers or governance guardrails, without causing decision fatigue or slowing progress.

In Closing

In Closing

SUP transferability is not the end—it’s a beginning. And we have a rare opportunity to show how a DAO can move deliberately, but decisively.

SIP-5 respects:

- Constitutional process

- Legal and technical constraints

- The DAO’s right to vote on SUP’s core function

But also opens the door to further checks and safeguards before final execution.

Let’s proceed with boldness—but not recklessness. I’m fully committed to working with the Foundation, Security Council, and every stakeholder here to ensure a secure, coordinated, and successful unlock of SUP that supports Superfluid’s mission for years to come.

Thank you all for your time, your trust, and your thoughtful engagement.

![]() The post aims to start formal discussions on SUP transferability.

The post aims to start formal discussions on SUP transferability.