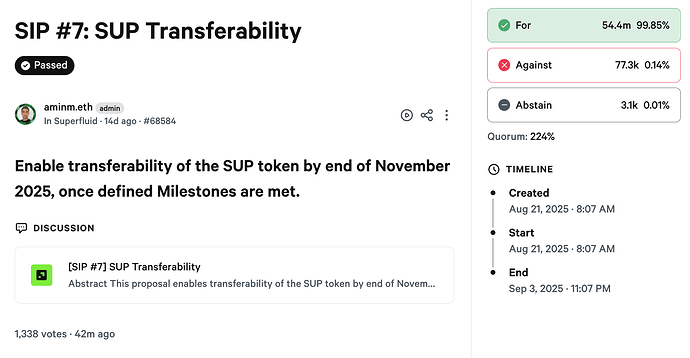

Abstract

This proposal enables transferability of the SUP token by end of November 2025, once defined Milestones are met. The proposal was drafted by the Transferability proposal Working Group and is submitted on their behalf.

SIP Type

Constitutional (modifies the SUP token)

Motivation

Progress the protocol’s decentralization through enabling transferability of SUP.

Key Terms

- SUP - The Superfluid governance token.

- Security Council - A committee who are signers of a multi-sig wallet, which has powers to perform certain Emergency Actions and Non-Emergency Actions.

- Transferability - A smart contract function that, once enabled, defines the conditions for SUP tokens to be withdrawn from Reserve contracts.

Rationale

- Transferability of the SUP token allows new stakeholders to join the DAO and aligns Superfluid with other mature governance systems in the Ethereum ecosystem.

- It’s in the long term interest of DAO to ensure that Transferability occurs after defined Milestones are met.

Transferability Milestones

This proposal defines 7 Transferability Milestones listed below and requests the Superfluid Foundation to coordinate their completion by end of November 2025.

Milestones marked ![]() are deemed to have been completed

are deemed to have been completed

Milestones marked ![]() are deemed work-in-progress

are deemed work-in-progress

Distribution – SUP distributed via SPR, +8% of supply to +40k DAO members so far

Utility – Voting is live, Rewards are live, Staking to go live, Feesa not a v1 milestone

Liquidity – Initial liquidityb for SUP to be bootstrapped

Security – SUP Reserve mechanism audit completed

UX – Comms and UX to be ready for transferability

Governance – Forum is active, Voting exceeds 1000 members

Macro – Market sentimentc neutral or higher for 2 consecutive weeks

Notes on Milestones:

a. Utility - Protocol v1 has no fees. v2 most likely will have fees which will accrue to the DAO

b. Liquidity - Foundation to ensure adequate funding available for healthy SUP market dynamics through means such as: allocating portion of Foundation’s SUP allocation for liquidity providers, engaging market makers, coordinating liquidity deployment with transferability and initiating SUP emissions to liquidity providers or market makers

c. Macro - Leading indices include EF, CMC, CG

Steps to Implement

1. DAO - This proposal falls under a Constitutional vote, requiring 5% Quorum, to be executed as prescribed by the Constitution.

2. Superfluid Foundation - Upon successful passage, the Superfluid Foundation is requested to coordinate execution of outstanding Milestones and instruct the Security Council to execute SUP Transferability by end of November 2025.

3. Security Council Execution - Execute Transferability

Timeline

- DAO Vote

- Day 0: Call for voting lasting 7 days

- Day 7: DAO votes on Snapshot, lasting 14 days

- Day 21: Voting ends and if successful a 7 day waiting period follows

- Milestones completion coordinated by the Foundation

- Execution by Security Council by end of November 2025.

Overall Cost

Any incremental costs incurred by the Foundation for execution of outstanding Milestones will be duly communicated by the Foundation.