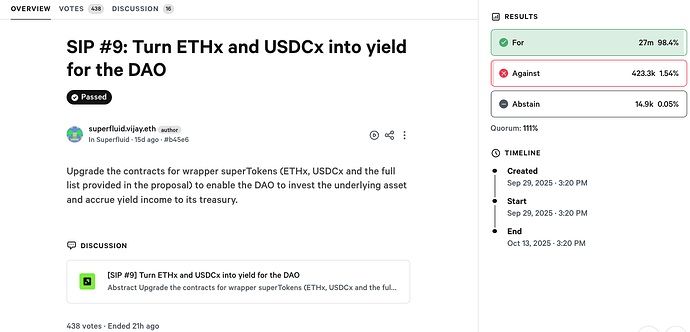

Abstract

Upgrade the contracts for wrapper superTokens (ETHx, USDCx and the full list provided below ) to enable the DAO to invest the underlying asset and accrue yield income to its treasury.

Type

Constitutional [Protocol Upgrade]

Motivation

Create revenues for the Superfluid DAO.

Background

Superfluid has always operated through two main axis:

- Pure SuperTokens (STREME, SUP, USND)

- Wrappers (OPx, USDCx, ETHx, MATICx)

I believe it’s now time to start generating yield on these assets.

Based on defillama data which was recently updated, the Superfluid protocol has around $26M TVL.

Of this, only a small part is represented by Pure SuperTokens.

Instead, in large majority, the tokens are wrappers.

The largest is OP, while the others are USDCx and ETHx.

ETHx is spread across a few networks, but in large part used in SuperBoring (at the moment), and until recently by AlfaFrens too.

Rationale

It has become common practice at this point for everyone to seek yield on assets deposited in smart contract platforms. While the risks associated with this were previously considered too high, this is no longer the case.

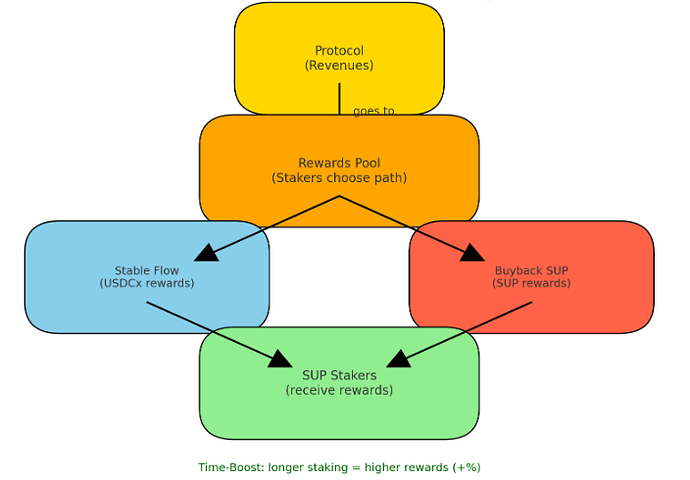

This also focuses the DAO on specific revenue metrics. Going forward, I expect SPR proposals to incentivise adding ETHx/USDCx TVL, in order to increase the volume of buybacks. This is in contrast to existing proposals, which overall are a net SUP cost to the DAO.

Based on the current top holdings of 1.5M$ in USDCx and 500K in ETHx, and expected yields of around >5% for USDC and >2% for ETH, I expect the DAO to generate ±90K USD in yield from day one.

While this might seem like a small amount, it is also a very clear way for the DAO to generate yield, and a very simple metric to incentivise (ETHx / stablecoin TVL) which can quickly 10x with the right incentives and activations.

For example, when SUP is tradable, it could be paired with ETHx, rather than WETH. This would increase TVL significantly, without making any difference to the users

Similarly, Streme.fun could start creating coins paired with ETHx rather than ETH.

If the ecosystem comes around to using ETHx and other yielding assets, we will be able to create a strong flywheel for SUP, benefitting long term holders and stakers.

This proposal recommends the Foundation execute a first, “basic” implementation in order to be ready before SUP transferability, and then as a next step select a partner through a tendering process. This partner should be selected with the intention of increasing the risk/reward of the invested capital.

Specification

- Upgrade all relevant assets (marked for upgrade here to become “yielding assets”

- Assets will be automatically deposited/withdrawn from the corresponding AAVE Protocol pool

- The resulting yields will be accumulated by the DAO Treasury (dao.superfluid.eth)

Over time, we hope to see USDCx / ETHx embedding itself into more dApps, which will in turn benefit more from the community’s favor and larger SUP allocations.

Steps to implement

- Foundation Engineers upgrades relevant smart contracts

- Security Council deploys the upgrades onchain

- After the initial upgrade, the DAO will select a new partner to run the yield strategies in the future through a tendering process

Timeline

Call for voting - 7days

Vote - 14 days

Waiting period - 7 days

Engineering Development - timing TBC

Security review and deployment by Security Council

Overall Cost

Engineering - 2 engineering weeks

SUP Budget - none